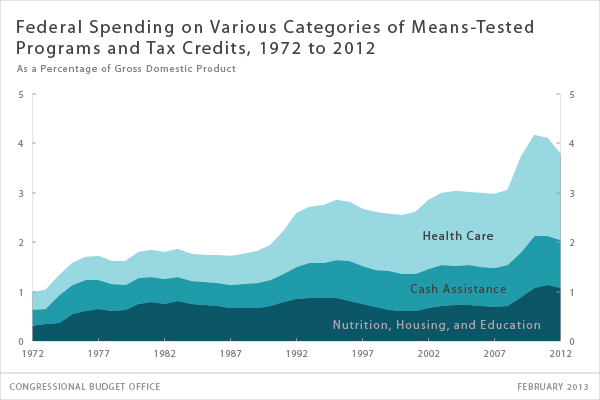

There’s a lo of talk about budgets, deficits, and debts. I don’t think this picture provides anything like a conclusive political point, but it does give some idea of the scale of “entitlement” spending, which for Greg Mankiw means “stuff the government has to give you if you prove you’re eligible”.

5 thoughts on “Mankiw: Growth of Entitlement Spending”

Comments are closed.

Can you help me to understand why nobody takes the Budget seriously in Washington except the Ron Paulites (or so it seems).

I mean, the Democrats have shown zero interest in reducing deficits and having a balanced budget (even with raising revenues) and the Republicans don’t exactly have a great track record with it either.

Is our debt, with these unfunded liabilities, the gigantic looming catastrophe that some say it is or is it just scare mongering from fiscal hawks?

Because if it really is a big problem then it really begs the question of whether those growing the size and cost of government are purposely trying to wreck the future economy for some other purpose. I know this is getting into Glenn Beck territory, but I just don’t get it. Either it’s not as big a problem as people think (a la Paul Krugman), or these politicians are nefariously trying to bring to pass some sort of new economic order or they are just inept.

Yeah, ok, or maybe they’re just trying to get re-elected and the short term triumphs of saying you passed some important law in Washington are more important than truly lasting solutions to longer-term problems.

Help me to understand.

I think it is the last point. As economist Thomas Sowell put it,

“When we are talking about applied economic policies, we are no longer talking about pure economic principles, but about the interactions of politics and economics. The principles of economics remain the same, but the likelihood of those principles being applied unchanged is considerably reduced, because politics has its own principles and imperatives…Politics and the market are both ways of getting some people to respond to other people’s desire…Voters decide whether to vote for one candidate or another but they decide how much of what kinds of food, clothing, shelter, etc., to purchase. In short, political decisions tend to be categorical, while economic decisions tend to be incremental. Incremental decisions can be more fine-tuned than deciding which candidate’s whole package of principles and practices comes closest to meeting your own desires…Thinking beyond stage one is especially important when considering policies whose consequences unfold over a period of years. If the initial consequences are good, and the bad consequences come later-especially if later is after the next election-then it is always tempting for politicians to adopt such policies.” (Sowell, Applied Economics: Thinking Beyond Stage One. Basic Books, 2004, 1-5)

I think there are basically two things going on.

First, the really scary stuff is couple of decades out. If current projections hold, we’re talking about insolvency and bankrupting the nation. That’s very scary, but a lot of Democrats believe that we’ll be able to address the problem before it gets critical (we’ve done similar things in the past) . This isn’t entirely irrational, and added to that is the fact that most of the deficit growth since 2008 has been due to the recession (which lowers tax revenue, but not necessarily gov’t expenditures).

Second, and more importantly I think, is the matter of incentives. There’s no such thing as “the government”. There are individual representatives, their aids, their advisers, and so forth. It is simply not in their best interests to do anything to stop the rate of growth. You know who talked seriously about this issue? Mitt Romney. Not just in 2012, but back in 2008. What good did it do him?

It’s like with Obamacare: all the polls showed that people hated it, but if you asked them about the individual elements of it (e.g. no more barring people with pre-existing conditions) then they liked every single one. If you ask Americans about cutting the budget they say “Yes!” but if you ask them about cutting, say, the mortgage interest deduction they freak out and say “You can’t do that!”

So what politician is going to go out and try to tell spoiled, ignorant, reactionary Americans that they can’t have low taxes and a welfare state? It’s bad for business.

I remember doing on online discussion board for my Financial Management course last semester in which one of my classmates said everyone needed to “take ownership.” My response:

I agree that “everyone needs to take ownership.” Oddly enough, however, even those who supposedly support market systems attempt to manipulate government in their favor. Economist Luigi Zingales argued over the summer that if Romney wanted to win, he had to differentiate himself from both Obama and Bush with pro-market, anti-croynism rhetoric and policies. He pointed to a survey conducted as part of the Chicago Booth/Kellogg School Financial Trust Index that found only 19% of Americans reject the free market, yet 51% are suspicious of “the excessive power of big business.”[1] Arthur Brooks, formerly of Syracuse University and now president of the American Enterprise Institute, contends that the U.S. is a 70/30 nation, with 70% supporting the free market and 30% having negative views of it.[2] However, as both Bryan Caplan (George Mason University) and Paul Krugman (Princeton) have pointed out, those speaking out against government intervention tend to rely on it when it suits them.[3]

1. Luigi Zingales, “How Romney Can Win,” City Journal: Eye on the News (July 8, 2012): http://www.city-journal.org/2012/eon0708lz.html

2. Arthur C. Brooks, “America’s New Culture War: Free Enterprise vs. Government Control,” The Washington Post (May 23, 2010): http://www.washingtonpost.com/wp-dyn/content/article/2010/05/21/AR2010052101854.html

3. Bryan Caplan, “If Only: A Review of Arthur Brooks’ The Battle,” EconLog (May 24, 2010): http://econlog.econlib.org/archives/2010/05/if_only_a_revie.html; Paul Krugman, “Moochers Against Welfare,” The New York Times (Feb. 16, 2012): http://www.nytimes.com/2012/02/17/opinion/krugman-moochers-against-welfare.html

Low taxes and a welfare state is called ‘slavery’. You’re a slave, thus you don’t pay taxes because you don’t earn anything and your owner takes ‘care’ of you…..