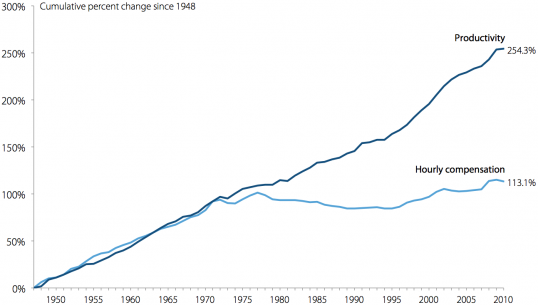

The above chart has been a talking point for the past couple years. Economic theory posits that an increase in capital per worker leads to increase output per worker which leads to increased income per worker. However, there has been a supposed wedge between productivity and worker compensation since the 1970s. Yet the Manhattan Institute’s Scott Winship argues otherwise. He lists 6 keys to properly analyzing production and wages:

- Look at hourly pay, not annual household or family income.

- Look at hourly compensation, not hourly wages.

- Look at the mean, not the median.

- Compare the pay and productivity of the same group of workers.

- Use the same price adjustment for productivity and for compensation.

- Exclude forms of income that obscure the fundamental question of whether workers receive higher pay when they produce more value.

Number four is especially important:

[The chart above] compares the compensation of production and nonsupervisory workers in the private sector to productivity in the overall economy. The twenty percent of the workforce that falls outside “production and nonsupervisory workers” are excluded from the compensation trend—a group that includes supervisors, who are higher-paid than non-supervisors. Meanwhile, the productivity trend includes them. If productivity has increased primarily among supervisory workers, then we wouldn’t expect compensation among other workers to track productivity growth.

In number six, he states, “Technically, if one is interested in whether workers are being fairly compensated, it probably makes the most sense to compare the growth of compensation to the growth of compensation plus profits. More broadly, one might be interested in whether compensation is growing in line with the income going to owners of capital generally (including those who receive rent or interest).”

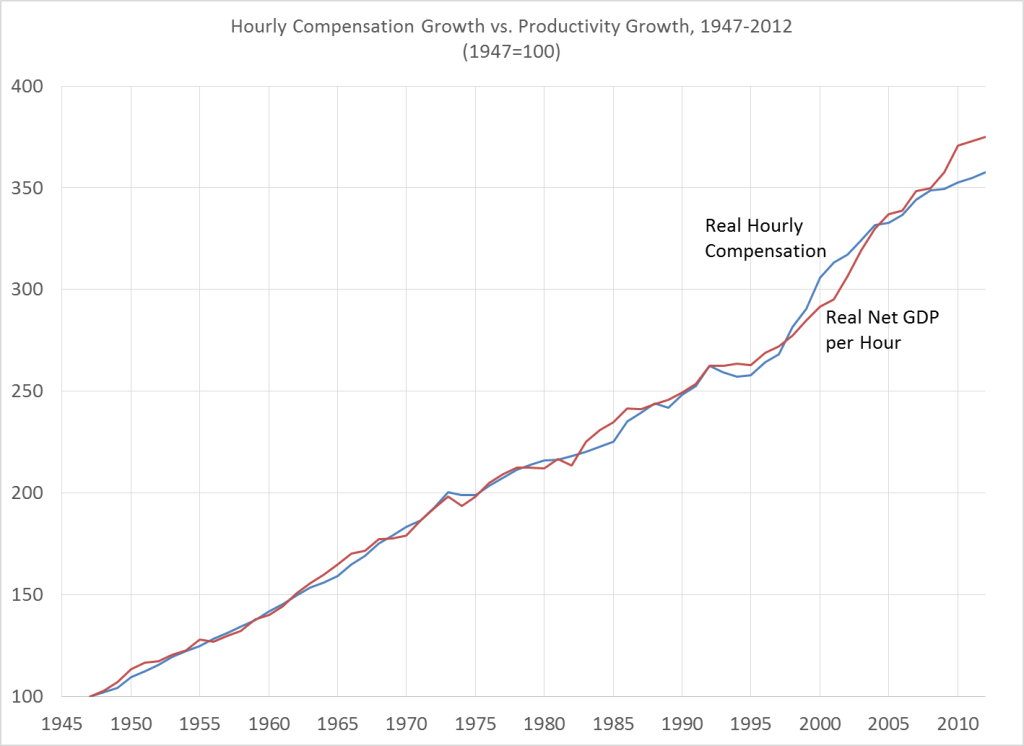

He produces a new chart that looks at “hourly compensation and compare[s] it to “net” productivity (excluding depreciation and also proprietors’ income). Both apply to the “nonfarm business sector,” which excludes the parts of GDP produced from the farm, government, non-profit, and housing sectors, thereby avoiding the issues of homeowners renting to themselves and of indirect taxes (along with other measurement issues in the government sector).” Furthermore, it “use[s] the same price adjustment for both compensation and productivity.” Finally, it excludes proprietors’ income (income from one’s business), “as it is not at all clear how to allocate that category into income from labor and income from capital”:

Winship clarifies that ““labor” includes extremely well-paid executives as well as minimum-wage workers, so the fact that labor’s piece of the pie hasn’t shrunk does not mean that inequality between workers hasn’t grown. But it does complicate unified theories of rising inequality.”