Building on the work of Stanford economist Nicholas Bloom and the World Management Survey, new research suggests that management quality matters for firm adaptability to adverse competitive shocks. The researchers explain,

Studying the way that corporations adjust to competitive shocks is difficult, and isolating the role of management even more so. New technology directly affects the productivity of firms, but it simultaneously transforms the competitive environment to which management needs to adapt. It is difficult to disentangle the role of external competitive forces from the direct effects of technological change. Policy shocks provide better opportunities to isolate the firm response because they do not directly emanate from an underlying process that is shaping the productivity of a firm. Recent research has therefore focused on policy shocks, such as a new trade agreement, unexpected exchange-rate shocks, or changes to the minimum wage.

Emerging markets might provide a better setting for a test of the relevance of management practice, because these markets have firms which differ more widely in their governance and management quality. Our recent research focuses on the productivity response of Chinese firms to external labour cost shocks (Hau et al. 2016). Many industries in China feature a large numbers of state-owned firms (SOEs), private Chinese firms, and foreign firms. Each have very different management practices…Chinese firms have undergone regular large labour cost shocks because of large revisions to the minimum wage set at the local level. In the seven-year period from 2002 to 2008 alone, there were more than 17,000 minimum wage increases in China’s 2,852 counties and cities…For firms with many workers at, or near, the minimum wage, these minimum wage increases often had a dramatic impact on average labour cost.

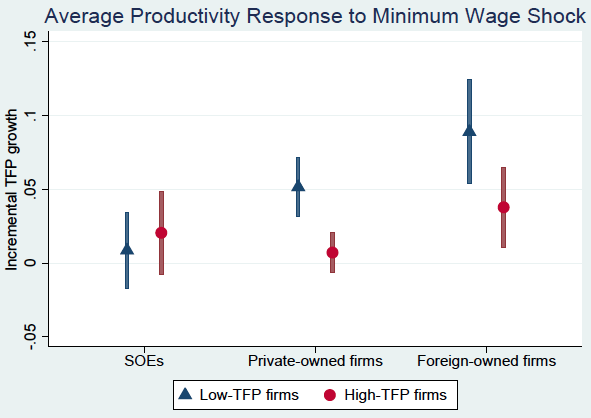

What were the firm responses to the 20% increase in the minimum wage?

The incremental productivity increase of SOEs [state-owned firms] was small and statistically insignificant (indicated by the vertical line representing a 95% confidence interval around the mean effect). Private firms show a statistically significant productivity response if their initial productivity is low, whereas foreign firms show by far the largest productivity increase in the year of the minimum wage increase. The point estimate of incremental TFP growth, just under 10%, is economically large and corresponds to almost a full year of trend growth. External competitive shocks therefore trigger large productivity improvements in some firms, but not in others. Ownership structure accounts for a large proportion of this variation.

Drawing on previous research, the authors draw up three dimensions to measure the quality of firm management:

- Monitoring practices: The collection and processing of production information;

- Target-setting practices: The ability to set coherent, binding, short-term and long-term targets; and

- Incentive practices: Merit-based pay, promotion, hiring, and firing.

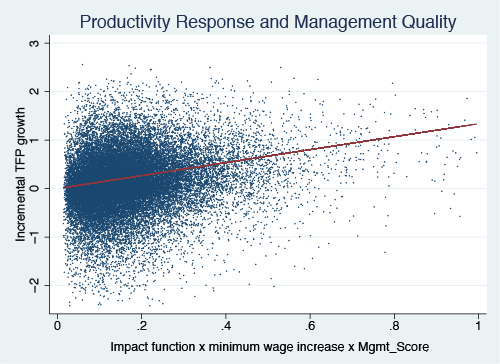

Their findings indicate that larger firms–especially foreign-owned–are better managed, while state-owned were the least well managed. The graph below “illustrates that the positive productivity response to the labour cost shock tends to be, ceteris paribus, larger for firms with a higher predicted management quality.”

The “evidence indicates better-managed firms adapt better to adverse competitive shocks, and suggests that management quality matters for this adaptability.” In other words, management matters.