Probably not. Reporting on a 2016 study, RealClearScience explains,

To distill the finding, a team of researchers based out of Tel-Aviv University first developed an algorithm to model wealth inequality in the United States between 1930 and 2010. Primarily based on income from wages, income from wealth (profits, rents, dividends, etc.), and changes in capital value (property, shares, etc.) the resulting model correlated closely (p=.96) with historical data on wealth inequality.

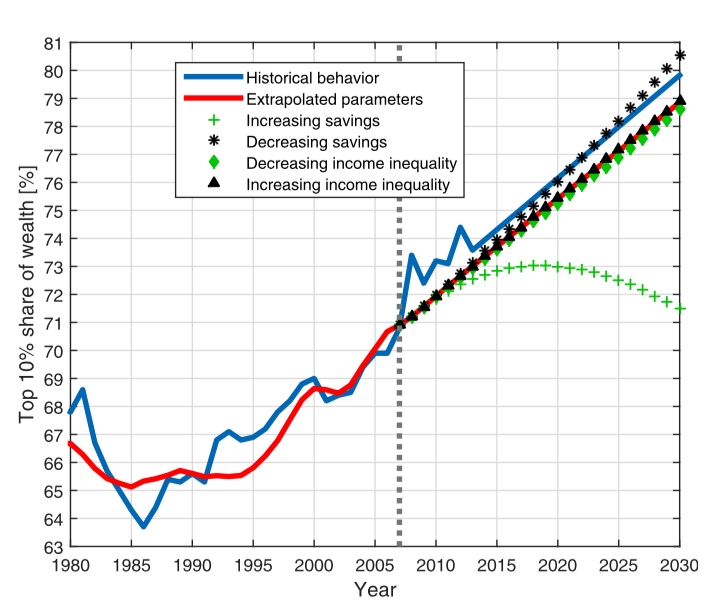

The researchers then used their model to predict the future. What would happen, they wondered, if income inequality was varied? In their model, income inequality was tied to a metric called the Gini index, a statistical measure of inequality used for decades. They found that altering income inequality to a Gini index of 0.1 (very low inequality) resulted in the top 10% controlling 78.6% of wealth in 2030, while raising income inequality to a Gini index of 0.9 (very high inequality) resulted in the top 10% controlling 79.3% of wealth in 2030, hardly a significant difference.

The article continues,

According to the researchers, the lack of effect isn’t actually surprising.

“When income tax is increased, the top earners, who are not necessarily the wealthiest individuals in the population, have a larger difficulty of accumulating wealth, with respect to the wealthiest. On the other hand, it barely affects the wealthiest individuals. Therefore, such an increase might even deepen the wealth gap.”

“Progressive taxation, which might have a significant effect on the distribution of income, will have a small effect on wealth inequality,” they add.

The team behind the current study is not the only group to return such a result. Just last year, experts at the Brookings Institute created their own model and found that increasing the top tax rate from 39.6% to 50% wouldn’t even dent income inequality, let alone wealth inequality.