Looks that away according to a Spring 2018 article in The Independent Review. Economist Carlos Newland constructs a Free-Market Mentality Index (FMMI) in an attempt to quantify the change in attitudes. He writes,

What is the basis on which institutional frameworks favorable to abundance or growth are built? For Michael Porter (2000), that basis is the economic culture or mentality of the population. Porter argues that to achieve sustainable growth a society must have an archetype of productivity, including a comprehension of the factors that influence the efficiency of the economy. These factors include an appreciation of competition, openness to globalization and international trade, an understanding that free markets benefit a majority of the society, and an awareness of the pernicious effects of government favoritism. Porter argues that without this paradigm it is probable that an alternate view may take root in a society, one that is more favorable to the existence of noncompetitive rents, such as those granted by protectionist economic policies. The optimal paradigm, Porter points out, should not be confined to the upper echelons of a society but instead should permeate its entirety, including the working class. If this diffusion is absent, reforms favorable to higher productivity will probably face political opposition (pg. 571).

In order to take a mental temperature so speak, Newland uses

items included in the World Values Survey (WVS), an ongoing international poll conducted from 1981 to 2014 (when the most recent survey was published; a current one is not yet available). The WVS is a global collaborative effort aimed at learning the opinions of inhabitants of many nations of the world about a large set of topics. Via the construction of a comparative index, I used three items included in the WVS to study the presence and degree of a free-market or capitalist ideology (henceforth used as synonyms) in these nations over the course of the past two decades. I defined this mentality as one favorable to competition, to the action of private enterprise, and to the view that economic interaction generates wealth. Although the basic WVS questionnaire includes many other assertions that reflect a capitalist mindset, the fact that the answers are available for only some countries reduces the set that can be employed. Only four of the six WVS editions published up to 2014 include all three of the questions that I used to compose the FMMI: 1990, 1996, 2006, and 2012. There are twenty-seven countries in the 1990 sample, a figure that grows to fifty-eight for 2012. The indicator is fragile and based on a very limited set of variables, but I believe it reflects, perhaps roughly, the relative attitudes in different countries toward free markets and their evolution over time (pg. 572).

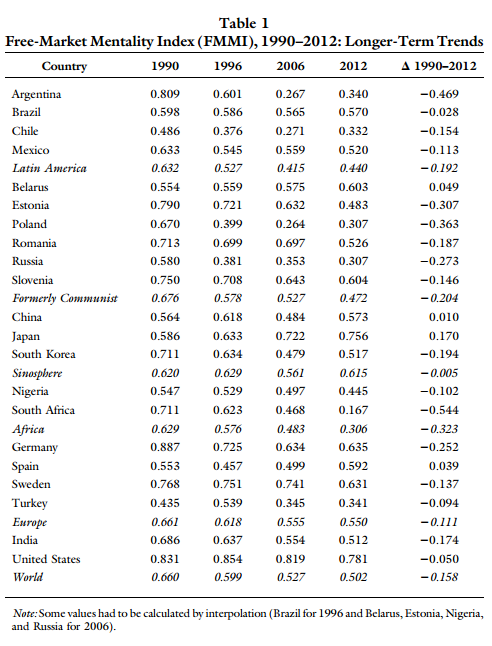

The results? The table below

clearly shows that a strong downward tendency in the support of capitalism occurred in the world between 1990 and 2012, with the global FMMI falling by 24 percent. This fall has been gradual and continuous and therefore cannot be attributed to the occurrence of the Great Recession of 2007–9. When data are separated by groups of nations, the negative trend is very clear in the case of formerly Communist countries, Latin America, and Africa. The result for the Sinosphere is more ambiguous and diverse: the score for Japan has grown over time, China shows some stability, and the values for South Korea have fallen. Marks for Europe have generally decayed, and the same has happened for the United States (pg. 575).

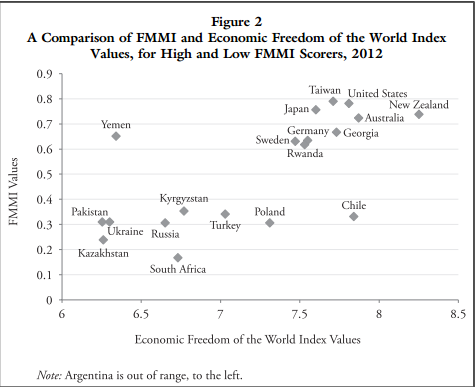

What makes this disturbing is the FMMI’s “weak, but positive correlation” with the Economic Freedom of the World Index. The comparison between the two indexes “shows that in general countries with a high pro-capitalist ideology also have freer and more competitive economies: Taiwan, the United States, New Zealand, Australia, Germany, Sweden, and Japan” (pg. 577).

While the FMMI “is undoubtedly a rather crude measure,” it nonetheless “shows that an important global ideological shift has occurred since the late 1990s. From an initial situation of appreciation of the virtues of capitalism and competitive forces in the 1990s, much of the world has shifted to a greater faith in government intervention and regulation.” This is problematic, since the data also show that “a strong capitalist mentality coexists with (and probably generates) a favorable institutional framework, exemplified by many of the wealthiest countries in the world, such as the United States, Germany, and Japan” (pg. 579-580). Since institutions matter, this is a bit concerning.