This is part of the Stuff I Say at School series.

The Assignment

Group Report on Dani Rodrik’s article “What’s So Special About China’s Exports?“

The Stuff I Said

I’m going to bring in some resources that push back against Rodrik.

A 2008 paper finds that Rodrik’s “analysis does not adequately address a significant factor that is important in accounting for China’s superior export performance. This factor is the regional trade and production integration mediated by foreign direct investment (FDI) in East and Southeast Asian economies. A close look at the role of FDI in connecting China with other Asian countries to form a regional trading network would improve the understanding of the characteristics of China’s trade structure and the challenges China faces in international trade” (pg. 100). In my view, Liang’s paper actually highlights the importance of trade and integration contra Rodrik’s somewhat dismissive attitude toward it. Yet, this may still be overestimating the “specialness” of China’s exports. A 2010 paper also points out that Rodrik relies on China’s average per capita GDP (PCGDP) to determine the “specialness” of its exports, yet “China’s coastal provinces, which account for over 90% of China’s exports, have an average PCGDP level 1.5 to 2 times that of China’s overall PCGDP. Without taking this into account, one would underestimate the export capability against which the relative export sophistication is evaluated.” What’s more, “although many of China’s exported goods belong to sophisticated categories, they may well be the low-quality varieties” (pg. 483). When these factors are controlled for, the “specialness” of China’s exports declines.

Rodrik is right to point out that China’s growth has largely been under what many call “state capitalism.” Yuen Yuen Ang’s work has traced the co-evolutionary development between markets and institutions within China. But as one of her book’s reviewers notes, the bureaucratic corruption that played a role in spurring market-oriented growth may end up holding it back. (The good thing is that recent evidence suggests that market reforms and anti-corruption reforms create a virtuous cycle.) However, what I find so odd about Dani Rodrik’s somewhat heterodox position on globalization is that he seems to think that because China has experience incredible growth in the midst of its government’s heavy-handedness, the answer for development is state intervention. He basically watches communist China grow once it begins to liberalize its markets and his response is, “Developing countries need more state intervention.”

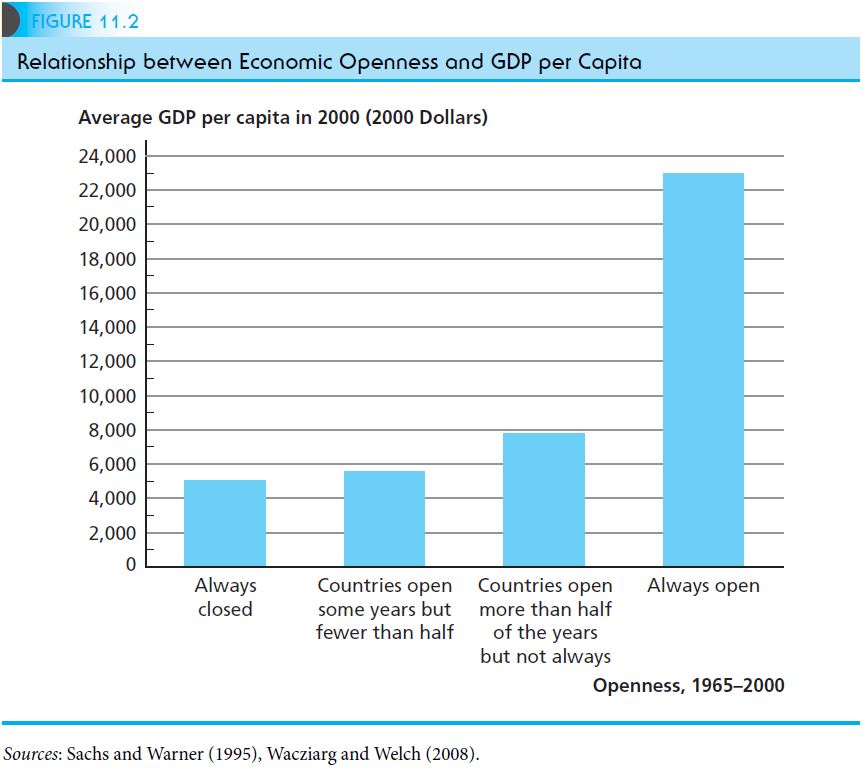

Economists like Acemoglu and Robinson don’t deny that economic growth can occur under extractive institutions. It’s just that it can’t last in the long run. This is why openness is so important. As David Weil demonstrates,

Our first approach is to see how growth rates compare in open and closed countries…First, the average growth rate of income in the closed group, 1.5% per year, was significantly lower than in the open group, 3.1% per year. Second, among the economies that were closed some or all of the time, there is no observable relationship between the initial level of a country’s GDP and its subsequent rate of growth. Among the countries open to trade, by contrast, we find strong evidence of convergence:Poorer countries that are open tend to grow faster than richer countries. Putting the results in the two figures together, we can see that poor countries that are open to trade grow faster than rich countries, and poor countries that are closed to trade grow more slowly than rich countries. Our second approach to exploring the effect of openness on growth is to consider how changes in a country’s degree of openness affect growth rates. If within a particular country, a change in trade policy (a trade liberalization or the imposition of new trade restrictions) is followed by a change in the growth rate of output, this pattern can supply us with evidence about the way trade affects income.One of the most sweeping examples of trade liberalization comes from 19th-century Japan. In the 12 years after Japan ended its self-imposed economic isolation in 1858, the value of Japanese trade with the rest of the world rose by a factor of 70. The opening to trade is estimated to have raised Japanese real income by 65% over two decades, and put the country on a path of growth that would eventually cause it to catch up to European levels of income…This same effect of trade liberalization has occurred in the 20th century as well. In South Korea, following a sweeping liberalization of trade in 1964–1965, income grew rapidly, doubling in the next 11 years. Similarly, Uganda and Vietnam experienced rapid growth in the 1990s, following their integration into the world economy.In all these examples, increased openness led to higher growth. Conversely,when we look at cases in which openness decreased, we see evidence that lower growth followed. For example, the trade embargo instituted by President Thomas Jefferson in 1807–1809 spawned widespread unemployment and bankruptcy in the United States. Similarly, the wave of tariff increases throughout the world in 1930, including the U.S. Smoot-Hawley tariff, contributed to the severity of the Great Depression of the 1930s (pg. 327-329).

Given the evidence above, I think China and other developing countries would do well to open their economies more.