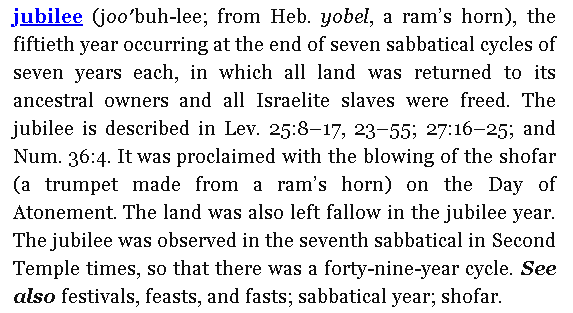

I saw this floating around Facebook recently with the news of Elizabeth Warren’s student loan plan. For those unfamiliar with what Mayfield is referencing, here’s the entry from the HarperCollins Bible Dictionary:

As another Bible dictionary clarifies, “Though Leviticus 25 does not explicitly discuss debt cancellation, the return of an Israelite to his land plus the release of slaves implies the cancellation of debts that led to slavery or the loss of land.”

So does Warren’s plan benefit “the marginalized”?

According to Adam Looney at the Brookings Institution, Warren’s proposal is “regressive, expensive, and full of uncertainties…[T]he top 20 percent of households receive about 27 percent of all annual savings, and the top 40 percent about 66 percent. The bottom 20 percent of borrowers by income get only 4 percent of the savings. Borrowers with advanced degrees represent 27 percent of borrowers, but would claim 37 percent of the annual benefit.”

He continues,

Debt relief for student loan borrowers, of course, only benefits those who have gone to college, and those who have gone to college generally fare much better in our economy than those who don’t. So any student-loan debt relief proposal needs first to confront a simple question: Why are those who went to college more deserving of aid than those who didn’t? More than 90 percent of children from the highest-income families have attended college by age 22 versus 35 percent from the lowest-income families. Workers with bachelor’s degrees earn about $500,000 more over the course of their careers than individuals with high school diplomas. That’s why about 50 percent of all student debt is owed by borrowers in the top quartile of the income distribution and only 10 percent owed by the bottom 25 percent. Indeed, the majority of all student debt is owed by borrowers with graduate degrees.

Drawing on 2016 data from the Federal Reserve’s Survey of Consumer Finances, Looney’s final analysis

shows that low-income borrowers save about $569 in annual payments under the proposal, compared to $900 in the top 10 percent and $2,653 in the 80th to 90th percentiles. Examining the distribution of benefits, top-quintile households receive about 27 percent of all annual savings, and the top 40 percent about 66 percent. The bottom 20 percent of borrowers by income get 4 percent of the savings…[W]hile households headed by individuals with advanced degrees represent only 27 percent of student borrowers, they would claim 37 percent of the annual savings. White-collar workers claim roughly half of all savings from the proposal. While the Survey of Consumer Finances does not publish detailed occupational classification data, the occupational group receiving the largest average (and total) amount of loan forgiveness is the category that includes lawyers, doctors, engineers, architects, managers, and executives. Non-working borrowers are, by and large, already insured against having to make payments through income-based repayment or forbearances; most have already suspended their loan payments. While debt relief may improve their future finances or provide peace of mind, it doesn’t offer these borrowers much more relief than that available today.

The Urban Institute’s analysis has similar findings (though their tone is more optimistic):

I’m not sure whether or not Warren’s plan is a good one (I’m skeptical, especially given some of the results abroad). But I’m not big on acting like college graduates in a rich country are the marginalized of society.