According to the Tax Policy Center,

The earned income tax credit (EITC) provides substantial support to low- and moderate-income working parents, but very little support to workers without qualifying children (often called childless workers). Workers receive a credit equal to a percentage of their earnings up to a maximum credit. Both the credit rate and the maximum credit vary by family size, with larger credits available to families with more children. After the credit reaches its maximum, it remains flat until earnings reach the phaseout point. Thereafter, it declines with each additional dollar of income until no credit is available (figure 1).

By design, the EITC only benefits working families. Families with children receive a much larger credit than workers without qualifying children. (A qualifying child must meet requirements based on relationship, age, residency, and tax filing status.) In 2018, the maximum credit for families with one child is $3,461, while the maximum credit for families with three or more children is $6,431.

…Research shows that the EITC encourages single people and primary earners in married couples to work (Dickert, Houser, and Sholz 1995; Eissa and Liebman 1996; Meyer and Rosenbaum 2000, 2001). The credit, however, appears to have little effect on the number of hours they work once employed. Although the EITC phaseout could cause people to reduce their hours (because credits are lost for each additional dollar of eanings, which is effectively a surtax on earnings in the phaseout range), there is little empirical evidence of this happening (Meyer 2002).

The one group of people that may reduce hours of work in response to the EITC incentives is lower-earning spouses in a married couple (Eissa and Hoynes 2006). On balance, though, the increase in work resulting from the EITC dwarfs the decline in participation among second earners in married couples.

If the EITC were treated like earnings, it would have been the single most effective antipoverty program for working-age people, lifting about 5.8 million people out of poverty, including 3 million children (CBPP 2018).

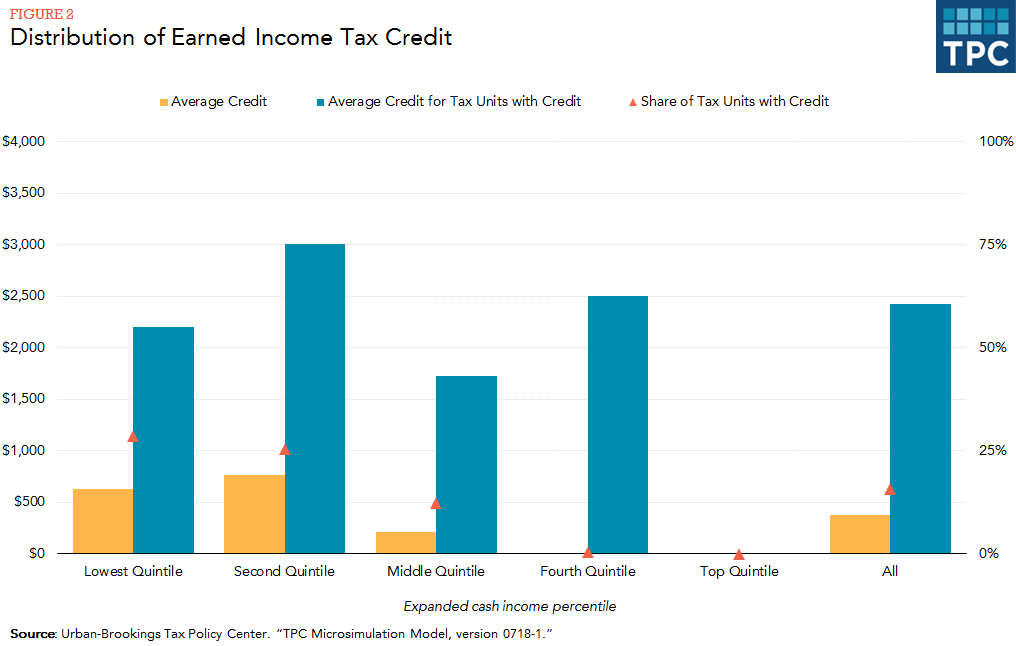

The EITC is concentrated among the lowest earners, with almost all of the credit going to households in the bottom three quintiles of the income distribution (figure 2). (Each quinitle contains 20 percent of the population, ranked by household income.) Very few households in the fourth quinitle receive an EITC (fewer than 0.5 percent).

Recent evidence supports this view of the EITC. From a brand new article in Contemporary Economic Policy:

First, the evidence suggests that longer-run effects[1]”Our working definition of “longer run” in this study is 10 years” (pg. 2).[/ref] of the EITC are to increase employment and to reduce poverty and public assistance, as long as we rely on national as well as state variation in EITC policy. Second, tighter welfare time limits also appear to reduce poverty and public assistance in the longer run. We also find some evidence that higher minimum wages, in the longer run, may lead to declines in poverty and the share of families on public assistance, whereas higher welfare benefits appear to have adverse longer-run effects, although the evidence on minimum wages and welfare benefits—and especially the evidence on minimum wages—is not robust to using only more recent data, nor to other changes. In our view, the most robust relationships we find are consistent with the EITC having beneficial longer-run impacts in terms of reducing poverty and public assistance, whereas there is essentially no evidence that more generous welfare delivers such longer-run benefits, and some evidence that more generous welfare has adverse longer-run effects on poverty and reliance on public assistance—especially with regard to time limits (pg. 21).

Let’s stick with programs that work.