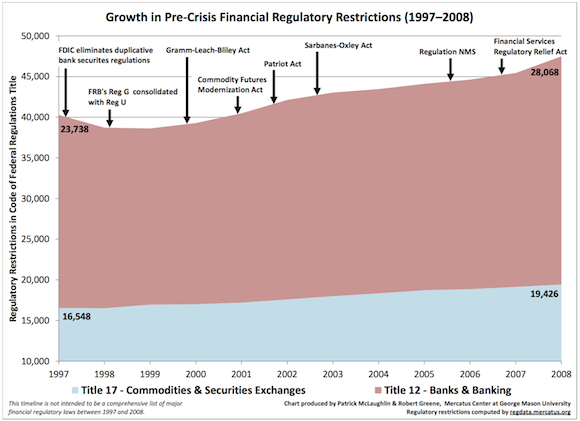

The following chart comes from the Mercatus Center at George Mason University. It shows the increase in regulations from 1997 to 2008, deflating the claim that “deregulation” led to the financial crisis.

The researchers concluded,

Using the Mercatus Center at George Mason University’s RegData, we find that between 1997 and 2008 the number of financial regulatory restrictions in the Code of Federal Regulations (CFR) rose from approximately 40,286 restrictions to 47,494—an increase of 17.9 percent. Regulatory restrictions in Title 12 of the CFR—which regulates banking—increased 18.2 percent while the number of restrictions in Title 17—which regulates commodity futures and securities markets—increased 17.4 percent.

…Total regulatory restrictions pertaining to the financial services sector grew every year between 1999 and 2008, increasing 23 percent during this time. The Patriot Act, the Sarbanes-Oxley Act, and Regulation NMS all contributed to this growth. The repeal of parts of the Glass-Steagall Act via the Gramm-Leach-Bliley Act did not result in noticeable deregulation of the financial services sector. Nor did the Commodity Futures Modernization Act facilitate overall financial deregulation. Not even the Financial Services Regulatory Relief Act of 2006, legislation intended to decrease regulatory burdens on the financial industry, reversed the ever-growing burden of regulatory restrictions faced by the financial services sector in the years leading up to the financial crisis.

While “deregulation” may be a dirty word among some of the political elite and their supporters, the chart above and video below should cause one to give pause and reconsider the costs of heavy-handed regulations.