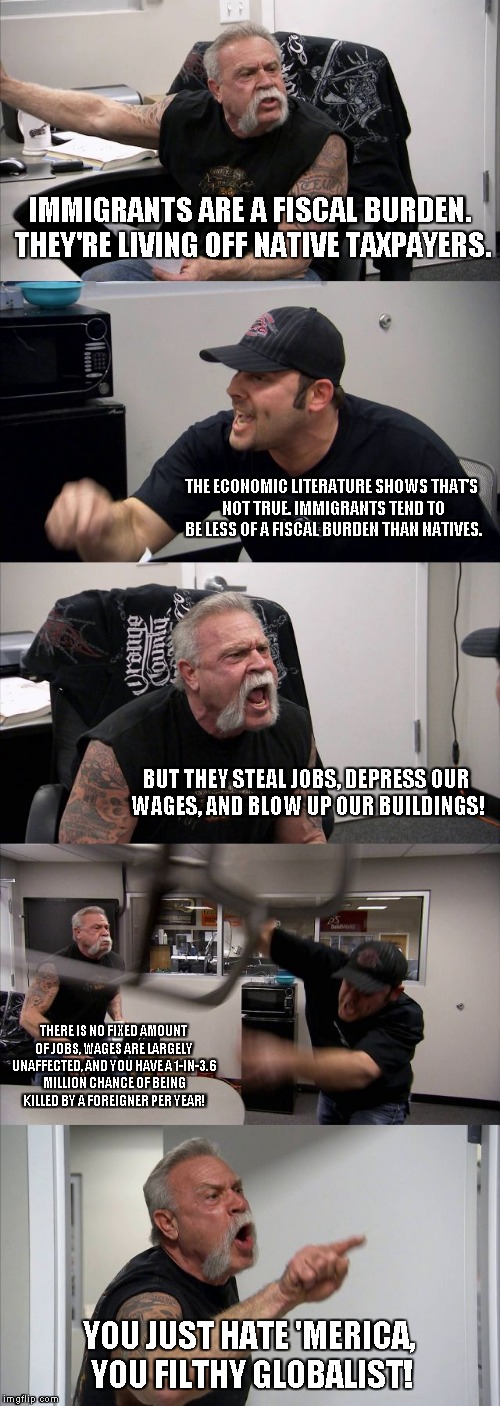

The link between political ignorance, immigration policy preferences, and support for redistribution are well-established. I’ve shared this portion from my BYU Studies Quarterly article before, but it’s worth repeating:

A particularly interesting aspect of public attitudes toward immigration is that of political ignorance. Multiple studies have shown that political ignorance is rampant among average voters, and this holds true when it comes to immigration policy. As legal scholar Ilya Somin explains, “Immigration restriction . . . is one that has long-standing associations with political ignorance. In both the United States and Europe,survey data suggest that it is strongly correlated with overestimation of the proportion of immigrants in the population, lack of sophistication in making judgments about the economic costs and benefits of immigration, and general xenophobic attitudes toward foreigners. By contrast, studies show that there is little correlation between opposition to immigration and exposure to labor market competition from recent immigrants.” One pair of economists found that those voting to leave the European Union in the Brexit referendum, who were motivated largely by a desire to restrict immigration, “were overwhelmingly more likely to live in areas with very low levels of migration.” Similarly, voters who supported Donald Trump during the US election were more likely to oppose liberalizing immigration laws (even compared to other Republicans), but least likely to live in racially diverse neighborhoods. In short, both political ignorance and lack of interaction with foreigners tend to inflame anti-immigration sentiments. These sentiments are what George Mason University economist Bryan Caplan refers to as antiforeign bias: “a tendency to underestimate the economic benefits of interaction with foreigners.” In fact, economists take nearly the opposite view from the general public on immigration (pgs. 80-82).

In regards to immigrants’ impact on welfare and the fiscal budget, I wrote,

A 2017 literature review by the National Academy of Sciences finds that the “fiscal impacts of immigrants are generally positive at the federal level and negative at the state and local levels” because state and local governments are the main providers of education benefits. Thee authors of the review are also quick to point out,“the net fiscal impact for any U.S. resident, immigrant or native-born, is negative. When fiscal sustainability is assumed to result in future spending cuts and tax increases, immigrants are more valuable than native-born Americans (that is, their net fiscal impact is greater in a positive direction).” These findings echo those of [Alex] Nowrasteh’s review of the literature. According to Nowrasteh, between 1950 and 2000, “immigration grew the US economy and produced more net tax revenue. . . . The low-skilled first generation consumed more welfare than they paid in taxes,but their descendants more than compensated for that initial deficit by producing a more positive dependency ratio for entitlement pro-grams, leading to a slightly positive contribution to the federal budget in the long run.” While many economic models “find that immigrants slightly diminish net tax revenue for state and local governments,” they increase the federal net tax revenue by more than the state and local decrease. Furthermore, “there is little evidence that migrants choose their state destination based on the generosity of the welfare system. . . .New immigrants are mainly choosing to reside in states with low levels of social welfare spending and growing economies and are moving away from states with high levels of social welfare spending and low economic growth.” Nonetheless, even if welfare spending did increase due to immigration (evidence suggests quite the opposite), this would be an argument for increasing restrictions on welfare, not immigration. Overall, as Nowrasteh concludes, “The economic benefits of immigration are unambiguous and large, but the fiscal effects are dependent upon the specifics of government policy over a long time period, which means that the net fiscal impact of immigration could be negative while the economic benefit is simultaneously positive. Looking at the results of all of these studies, the fiscal impacts of immigration are mostly positive, but they are all relatively small” (pgs. 99-100).

A recent study provides further support for these findings:

In a recent study (Alesina et al. 2018) we used commercial market research companies to run a large-scale survey and experiment on a representative sample of more than 22,000 natives in six countries: France, Germany, Italy, Sweden, the UK, and the US, mostly between January and March 2018. The sample countries were chosen because they have different economic and social systems, but all have recently faced policy challenges around immigration…In five of the six countries, the average native believed that there are between two and three times as many immigrants as there are in reality. For instance, in the US legal immigrants are about 10% of the population, but US respondents thought the figure was 30%. Similar gaps existed in Germany, France, Italy, and the UK. In Sweden, the country with the highest proportion of immigrants, the public perception of 27% was closest to the true share (18%).

Natives also got the origins of immigrants wrong. They particularly overestimated the shares of immigrants coming from regions that have recently been described as ‘problematic’ in the media, and the share of non-Christian immigrants – Christianity being the mainstream religion in their country. In all countries except France, respondents overestimated the share of Muslim immigrants. The US and Sweden had the biggest misperception. In the US, respondents thought the share of Muslim immigrants was 23% when in reality it is 10%, and in Sweden they believed the share was 45%, when it is 27%. In the UK, Italy, and Germany, this overestimation ranged from 10 to 14 percentage points. In all countries, including France, respondents underestimated the share of Christian immigrants by at least 20 percentage points. For instance, US respondents thought that 40% of immigrants were Christian, when 61% are. UK respondents believed 30% of immigrants were Christian, when the true figure is 58%.

In all countries, immigrants were viewed as poorer, less educated, and more likely to be unemployed than is the case. For instance, US natives believed that 35% of immigrants lived below the poverty line, while the real number is less than 14%. Natives also believed that immigrants relied heavily on the welfare state, with roughly one-third of all US, Italian, and French respondents, and one-fifth of all UK and German respondents, believing that an immigrant would receive more benefits than a native, even if both had exactly same income, family structure, age, and occupation. A large share of respondents also thought that immigrants were poor mainly because of lack of effort, rather than adverse circumstances.

These misperceptions were widely spread across all countries and groups of respondents. They were larger for respondents who are not college educated, who said they supported right-wing parties, or who worked in low-skilled occupations in immigration-intensive sectors. Respondents who personally knew an immigrant had less biased perceptions. Respondents in all countries also greatly exaggerated the share of immigrants among the poor or the low-educated. For example, US respondents thought that 37% of the poor were immigrants; the true number is 12%.

These skewed perceptions may lead natives to conclude that immigrants are a burden on the public finances of their country, and that they disproportionately benefit from redistribution. In fact, there is a strong negative correlation between the perceived share of poor who are immigrants and support for redistribution. This was captured by a redistribution support index that summarised the answers to all redistribution-related questions. Respondents who perceived that a larger share of the poor were immigrants supported less redistribution, even controlling for a detailed set of personal characteristics. Similarly, respondents who supported more immigration overall, as captured by an immigration support index that aggregated the answers to all questions related to attitudes towards immigration, also supported more redistribution.

The authors also found that “simply making respondents think about immigrants and their characteristics made respondents much more averse to redistribution. These respondents also decreased their actual out-of-pocket donations to charities that support low-income groups but do not target immigrants.” The good news is that accurate information regarding “the true characteristics of immigrants – their share, their origins, and their work ethic…significantly increased support for immigration policies.” For example, “Showing the respondents a day in the life of a hard-working immigrant fostered support for redistribution – confirming the importance of views about effort and ‘deservingness’ of the poor, as highlighted in the case of poor natives in Alesina and Glaeser (2004) and Alesina et al. (2018). But the experiments that showed respondents the true share and origins of immigrants did not generate significantly more support for redistribution.” Unfortunately, “negative priors dominated in subsequent answers to redistribution questions, even when they also received favourable information about immigrants.”

It’s an uphill battle.