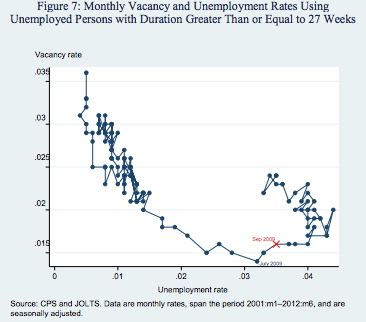

Writing for the Atlantic, Matthew Obrien points out the rather terrifying data on long-term unemployment in the United States.

The gist of this chart–and of the article–is that once a worker has been unemployed for more than 6 months they become virtually unemployable. Companies don’t even want to consider them. As a result, the high unemployment rate during the current Great Recession can permanently increase poverty in our nation because it has led to people having no job for extended periods of time. That’s all true, and it’s all scary. But at the end, Matthew makes an erroneous assumption. He writes:

It’s what economists call hysteresis, the idea being that a slump, left untreated, can make us permanently poorer by reducing our future ability to do and make things.

In reality, however, the problem is not just a slump left untreated. It’s a slump maltreated. That maltreatment in this case has been the extension of unemployment insurance basically without limit. This sounds compassionate, but economists have known since at least the 1970s that the direct result of extending unemployment benefits is that people are unemployed for longer. Two studies (both from the 1990s) make this point:

Sharp increases in the escape rate from unemployment both through recalls and new job acceptances are apparent for UI recipients around the time of benefits exhaustion. Such increases are not apparent at similar points of spell duration for nonrecipients. Second, our analysis of accurate administrative data from 12 states indicates that a one week increase in potential benefit duration increases the average duration of the unemployment spells of UI recipients by 0.16 to 0.20 weeks. – “The impact of the potential duration of unemployment benefits on the duration of unemployment” (Journal of Public Economics) Link

In this paper administrative data from the unemployment-insurance (UI) system are used to examine the distribution of unemployment spells. Hazard plots of the data reveal a strong clustering around the benefit exhaustion point. – “Unemployment insurance and the distribution of unemployment spells” (Journal of Econometrics) Link

In plain English: economists have known since the 1970s that the more you extend unemployment insurance the longer people remain unemployed. Why do we have a huge crisis with people remaining unemployed for 6 months or more? In part, at least, it’s a direct, foreseeable, and well-known effect of extending unemployment insurance. This problem is not merely caused by the Great Recession. It’s also caused by political pandering on the part of politicians in passing policies that sound nice but which lead directly to catastrophe.

What if those unemployed are able to use that time to increase their skills set?

And this is why you have become one of my favorite bloggers.

Casey Mulligan at the University of Chicago has a new book entitled ‘The Redistribution Recession’ claiming that “major subsidies and regulations intended to help the poor and unemployed were changed in more than a dozen ways after 2007,” many of which “reduced incentives for people to work and businesses to hire. He measures the startling changes in implicit tax rates that resulted from a labyrinth of new and expanded “social safety net” programs, and quantifies the effects of these changes on the labor market and the economy.” (http://redistributionrecession.blogspot.com/) I haven’t been able to find a copy of it locally, though I’ve followed him fairly consistently over the past couple years.

Joel-

That could help in some exceptional cases, but the problem is that employers tend to just glance at the resume, see that your most recent job ended more than 6 months ago, and stop looking. Even if you can get some specific new credentials on your resume (hard to do with no income), employers might never even look that close.

WalkerW-

Thanks! And the Casey Mulligan book sounds incredibly fascinating. Let me know if you manage to find and read a copy. I may have to pick it up myself.

I see your logic, no financial discomfort = reduced incentive to work. You have identified a problem. Do you have a solution in mind?

I personally think that more monitoring may be a benefit. An example would be assigning counselors to those out of work that would increase/decrease benefits based on needs and actions and provide coaching for attaining employment. I think the added cost for having another government employee would be money well spent if government assistance was reduced for those choosing not to make progress.

My two cents.

Well, the simplest thing to observe is that if people tend to get a job when benefits run out, and if 6-months is the point at which employers start to ignore your resume, then the maximum period for benefits should not be greater than 6 months. (It’s currently 99, I believe.)

There are a lot of other creative ideas you could apply, but that one seems pretty obvious and important.