You’ve probably heard a lot about the growing gap between average worker pay and CEO pay. This seems like a legitimate concern, but I’ve had some questions about the data and the assumptions ever since I first started hearing the statistics. I would kind of expect, for example, that CEOs of larger companies would probably get paid more. So if you had two companies with 1,000 employees each and they merged and you ended up with one CEO of a company that had 2,000 employees, do you think he’d get a raise? So consolidation (which might be a bad thing for other reasons) might inflate the average worker to CEO salary ratio in ways that aren’t necessarily that bad.

In any case, the American Enterprise Institute[ref]A “center-right think tank.“[/ref] has a related critique of those figures. It turns out that most of them are based on a very small sample size (the WSJ looked at only 300 CEOs, the AP looked at only 337, and the AFL-CIO looked at 350). Not only are these samples small, but they’re also heavily skewed towards the biggest companies. And so, as the AEI points out, “Although these samples of 300-350 CEOs are representative of large, publicly-traded, multinational US companies, they certainly aren’t very representative of the average US company or the average US CEO.” Turns out, there are more than a quarter million CEOs in the country. Comparing average worker salary to the 350 or so from the biggest companies is like comparing average worker salary to the top 0.1% of CEO salaries.

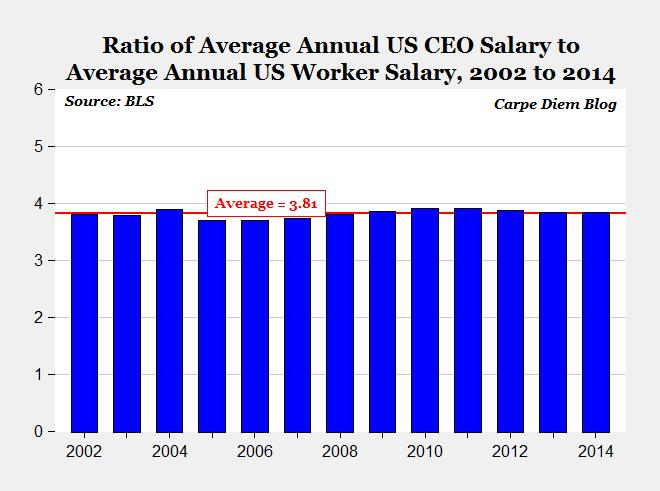

If you do compare average worker salary to average CEO salary (which can be done, the data is available), then the gap drops from 331:1 to 3.8:1 and the apparent growth over the last 13 years disappears.

I think a realistic assessment of the statistics is important, but I’m not willing to go quite so far as the AEI: “We should applaud the richest 300-350 CEOs as a group of the most successful American business professionals.” I think there are real questions about whether CEO pay is really an accurate reflection of their contribution to the economy, and there are also serious questions about how compensation structure can create perverse incentives where high-paid executives take risky strategies that end up rewarding them when they win and penalizing the rest of us (via bailouts and economic downturns) when they lose. And do the top 0.1% of CEOs really need our applause? Aren’t their salaries enough?

One interesting mathematical consequence of consolidation, presuming that CEOs of larger companies make more than CEOs of smaller ones, is that the number of CEOs making many times what their average employee makes will rise much slower than the number of people making many times less than their CEO. So you get different impressions of the situation based on whether you’re looking at CEOs who make relatively much vs. employees who make relatively little.

To illustrate: companies A and B have 100 employees each making $40,000/year and CEOs making $400,000/year. They merge, and the new CEO gets a pay bump of only 50%, so total CEO compensation has actually gone down. But now there are 200 employees serving under a CEO who makes $600,000/year. So, from the perspective of within-company inequality, the situation has gotten much worse (presuming such mergers tend to occur at larger-than-median companies, I think). From the perspective of total compensation by tier, it’s gotten better, and from the perspective of average CEO/worker compensation, it’s only gotten slightly worse (better if the ousted CEO starts up a new company with few employees and much lower CEO compensation).

All of which means that it’s possible to choose statistics to emphasize that things are really unequal, or not so unequal. Which way a particular piece makes it seem may well say as much about the author as about the facts.

As Kelsey said, it’s important to recognize that the BLS definition of CEO would seem to include relatively low level managers, of which there are obviously many, to bring down the average pay number. The manager-type with the highest rate of employment in the CEO category is “Management of Companies and Enterprises”, which would seem to include a gas station owner, for example.

http://www.bls.gov/oes/current/oes111011.htm

Kelsey’s point gets at a more interesting measure: Compensation per worker managed. Even then, you’d want to scale for the pay of each managed worker. A CEO who managed six hedge fund directors would be expected to make more than one who managed six gas station attendants. So it would be very difficult to get good data there, but it would be cool.

Another complication. For complex reasons (including tax policy, reporting requirements, follow-the-leader behavior) a large portion of compensation above $1 million per year is a function of earnings, profits or stock price. The dynamics are more like a return on capital than a return on labor. And for the top earners, the “above $1 million” amounts can be large (in absolute numbers and as a share of the total).

There are a number of ways to think about that top layer of compensation. I am not suggesting or advocating that those numbers be left out of the analysis. I am suggesting that it’s complicated.