Profit is often a dirty word among certain political ideologies. However, for those who defend the importance of profits, it is necessary to realize that sometimes they are signs of something amiss. As economist James Bessen explains,

Profits are up. Operating margins for firms publicly listed in the US show a substantial and sustained rise. Corporate valuations are up as well. That is good news for managers and investors. But is it good news for society?

Economists such as Joseph Stiglitz and Luigi Zingales find the rise potentially troubling for two reasons. First, higher profits create greater economic inequality. Rising aggregate profits correspond to a decline in labor’s share of output, contributing to stagnant wages. Also, greater profits for some corporations but not others may create greater wage inequality.

Second, the rise in profits might represent a decline in competition and, with that, a decline in economic dynamism. While a dynamic, competitive economy rewards innovative firms with high profits and punishes poor performers with low profits, sustained aggregate profits suggest, instead, that firms are able to get away with higher prices because competition is limited. Firms engage in political “rent seeking”—lobbying for regulations that provide them sheltered markets—rather than competing on innovation. If so, then high profits portend diminished productivity growth.

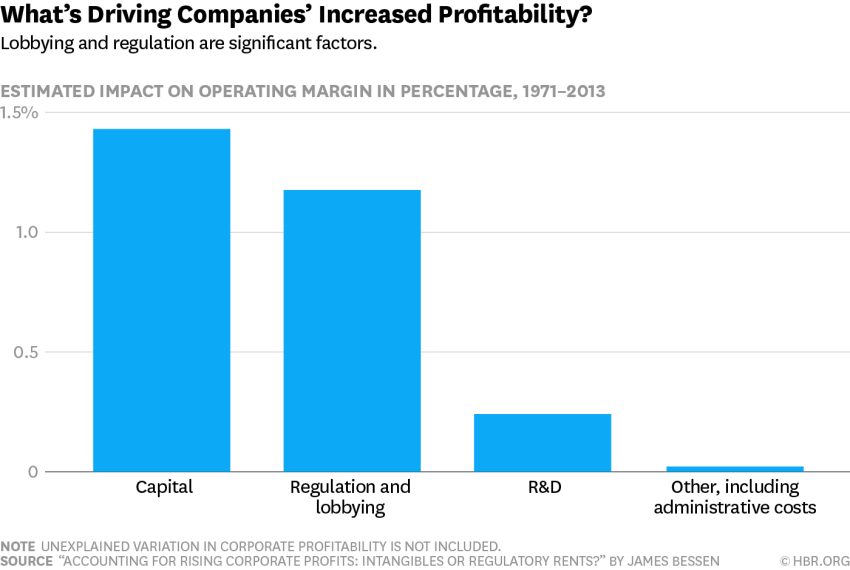

However, the increase in profits could be due to firms “increasingly making profitable investments in new technology, in IT, or in their organizational capabilities.” Bessen’s new research paper gets to the bottom of it:

I find that investments in conventional capital assets like machinery and spending on R&D together account for a substantial part of the rise in valuations and profits, especially during the 1990s. However, since 2000, political activity and regulation account for a surprisingly large share of the increase.

This is how rent-seeking, pro-business (vs. pro-market) attitudes, and crony capitalism drag down our economy.

Check out the full article over at Harvard Business Review.