From a new study:

A number of development economists have found higher gender inequality to be associated with slower development. Amartya Sen (1990) estimated a large number of ‘missing women’, which resulted in skewed sex ratios, and argued that this has been one of history’s crucial development hurdles. Stephan Klasen, with various co-authors, used macroeconomic regressions to show that gender inequality has usually been associated with lower GDP growth in developing countries during the last few decades (Klasen and Lamanna 2009, Gruen and Klasen 2008). This resulted in development policies targeted specifically at women. In 2005, for example, UN Secretary General Kofi Annan stated that gender equality is a prerequisite for eliminating poverty, reducing infant mortality, and reaching universal education (UN 2005). In recent periods, however, a number of doubts have been made public by development economists. Esther Duflo (2012) suggested that there is no automatic effect of gender equality on poverty reduction, citing a number of studies. The causal direction from poverty to gender inequality might be at least as strong as in the opposite direction, according to this view.

…In a new study, we directly assess the growth effects of female autonomy in a dynamic historical context (Baten and de Pleijt 2018). Given the obviously crucial role of endogeneity issues in this debate, we carefully consider the causal nature of the relationship. More specifically, we exploit relatively exogenous variation of (migration-adjusted) lactose tolerance and pasture suitability as instrumental variables for female autonomy. The idea is that high lactose tolerance increased the demand for dairy farming, whereas similarly, a high share of land suitable for pasture farming allowed more supply. In dairy farming, women traditionally had a strong role, which allowed them to participate substantially in income generation during the late medieval and early modern period (Voigtländer and Voth 2013). In contrast, female participation was limited in grain farming, as it requires substantial upper-body strength (Alesina et al. 2013). Hence, the genetic factor of lactose tolerance and pasture suitability influences long-term differences in gender-specific agricultural specialisation. In instrumental variable regressions, we show that the relationship between female autonomy and human capital is likely to be causal (and also address additional econometric issues, such as the exclusion restriction, using Oster ratios, etc.).

Age-heaping-based numeracy estimates reflect a crucial component of human capital formation. Recent evidence documents that numerical skills are the ones that matter most for economic growth. Hanushek and Woessmann (2012) argued that maths and science skills were crucial for economic success in the 20th century. They observed that these kinds of skills outperform simple measures of school enrolment in explaining economic development. Hence, in the new study we focus on math-related indicators of basic numeracy. We use two different datasets: first, we use a panel dataset of European countries from 1500 to 1850, which covers a long time horizon; second we study 268 regions in Europe, stretching from the Ural mountains in the east to Spain in the southwest and the UK in the northwest.

Average age at marriage is used as a proxy for female autonomy. Low age at marriage is usually associated with low female autonomy. Age at marriage is highly correlated with other indicators of female autonomy, such as the share of female household heads or the share of couples in which the wife was older than the husband. Age at marriage is particularly interesting because of the microeconomic channel that runs from labour experience to an increase in women’s human capital. After marriage, women typically dropped out of the labour market, and switched to work in the household economy (Diebolt and Perrin 2013). Consequently, after early marriage women provided less teaching and self-learning encouragement to their children, including numeracy and other skills. Early-married women sometimes also valued these skills less because they did not ‘belong to their sphere’, i.e. these skills did not allow identification (Baten et al. 2017).

What do they find?

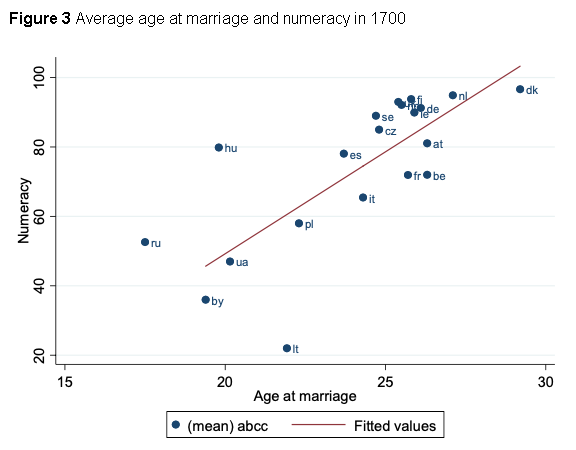

Figure 3 depicts a strong and positive relationship between average age at marriage and numeracy for the two half centuries following 1700 and 1800. Most countries are close to the regression line. Denmark, the Netherlands, Germany, Sweden, and other countries had high values of female autonomy and numeracy – interestingly, many of the countries of the Second Industrial Revolution of the late 19th century, rather than the UK, the first industrial nation. In contrast, Russia, Poland, Slovakia, Italy, Spain, and Ireland had low values in both periods.

In our regression analyses, we include a large number of control variables, such as religion, serfdom, international trade, and political institutions. We find that the relationship between female autonomy and numeracy is very robust.

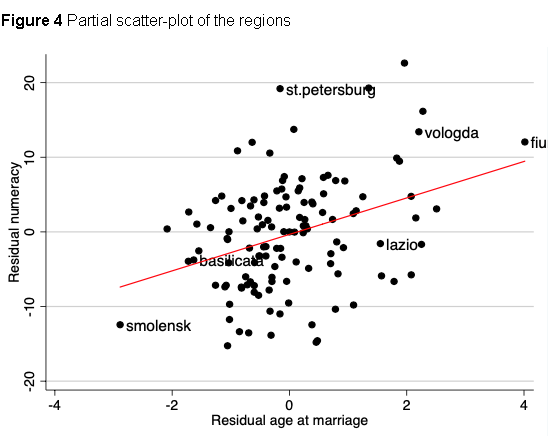

We also study the relationship between female autonomy and human capital formation at the regional level in the 19th century. Numeracy and age at marriage (after controlling for country-fixed effects and other control variables) yield an upward sloping regression line (Figure 4).

…In sum, the empirical results suggest that economies with more female autonomy became (or remained) superstars in economic development. The female part of the population needed to contribute to overall human capital formation and prosperity, otherwise the competition with other economies was lost. Institutions that excluded women from developing human capital – such as being married early, and hence, often dropping out of independent, skill-demanding economic activities – prevented many economies from being successful in human history.