Numerous studies over the years have demonstrated how ignorant the general public is regarding political matters.[ref]See Ilya Somin, Democracy and Political Ignorance: Why Smaller Government Is Smarter, 2nd ed. (Stanford, CA: Stanford University Press, 2016); Bryan Caplan, The Myth of the Rational Voter: Why Democracies Choose Bad Policies (Princeton, NJ: Princeton University Press, 2007); Christopher H. Achen, Larry M. Bartels, Democracy for Realists: Why Elections Do Not Produce Responsive Government (Princeton, NJ: Princeton University Press, 2016); Jason Brennan, Against Democracy (Princeton, NJ: Princeton University Press, 2016), Ch. 2: “Ignorant, Irrational, Misinformed Nationalists.”[/ref] This systemic ignorance and misinformation in turn warps the public’s policy preferences. AEI’s Mark Perry points out another example of public ignorance: corporate profits. He writes,

When a random sample of American adults were asked the question “Just a rough guess, what percent profit on each dollar of sales do you think the average company makes after taxes?” for the Reason-Rupe poll in May 2013, the average response was 36%! That response was very close to historical results from the polling organization ORC International polls for a slightly different, but related question: What percent profit on each dollar of sales do you think the average manufacturer makes after taxes? Responses to that question in 9 different polls between 1971 and 1987 ranged from 28% to 37% and averaged 31.6%.

How do the public’s estimates of corporate profit margins compare to reality? Not surprisingly they are off by a huge margin. According to this NYU Stern database for more than 7,000 US companies (updated in January 2018) in many different industries, the average profit margin is 7.9% for all companies and 6.9% for more than 6,000 companies excluding financials…Interestingly, for nearly 100 industries analyzed by NYU Stern, there’s only one industry that had a profit margin as high as 36% – and that was tobacco at 43.3%. The next highest profit margin was 26.4% for financial services, but more than 72% of industry profit margins were single-digits and the median industry profit margin is 6%.

“Big Oil” companies make a lot of profits, right? Well, that industry (Integrated Oil/Gas) had a below-average profit margin of 5.6% in the most recent period analyzed, and separately, the Production and Exploration Oil/Gas industry is losing money, reflected in a -6.6% profit margin. For the general retail sector, the average profit margin is only 2.3% and for the grocery and food retail industry, it’s even lower at only 1.6%. And evil Walmart only made a 2.1% profit margin in 2017 (first three quarters) which is less than the industry average for general retail, possibly because grocery sales now make up more than half of Walmart’s revenue and profit margins are lower on food than general retail. Interestingly, Walmart’s profit margin of 2.1% is actually less than one-third of the 6.5% the average state/local government takes of each dollar of Walmart’s retail sales for sales taxes. Think about it – for every $100 in sales for Walmart, the state/local governments get an average of $6.50 in sales taxes (and as much as $10.12 in Louisiana and $9.45 in Tennessee, see data here), while Walmart gets only $2.10 in after-tax profits!

Perry concludes, “The public’s complete overestimation of how much companies earn in profits as a share of sales explains a lot…The general public that believes in the fantasy-world of unrealistically, sky-high 36% profit margins would naturally think companies are just being greedy and stingy when they don’t pay higher “living wages” and have to be forced to do so through minimum wage legislation. If the average person could realize that a 36% profit margin isn’t even close to reality and that the typical, median firm has a profit margin of only less than 8% or almost 30 percentage points below what the public thinks is a normal profit margin, then hopefully the average person would become a little more realistic about how the business world operates. Companies aren’t being stingy when they pay competitive wages, they’re just trying to survive on what are sometimes razor-thin profit margins, in a competitive environment where there’s not a large margin of error.”[ref]Perry also has a great post and WSJ article about CEO pay.[/ref]

To test this prediction, we regressed participants’ support for redistribution simultaneously on their dispositional compassion, their dispositional envy, and their expected personal gain (or loss) from redistribution. As predicted, the three motives have positive, significant, and independent effects on support for redistribution. This is true in the four countries tested: the United States (US) (study 1a), India (IN) (study 1b), the United Kingdom (GB) (study 1c), and Israel (IL) (study 1d)—standardized regression coefficients (β values): compassion, 0.28–0.39; envy, 0.10–0.14; self-interest, 0.18–0.30. Jointly, these motives account for 13–28% of the variance in support for redistribution. Adding to the regression models age and gender, or age, gender, and S[ocio]E[conomic]S[tatus], does not appreciably alter the effect of the emotion/motivation triplet, or the total variance accounted for. We note that age did not have significant effects in any country. Gender had significant effects in the United States and the United Kingdom (females more opposed to redistribution), but not in India or Israel. SES had a significant (negative) effect in the United Kingdom, but not in the other countries (Ibid.).

To test this prediction, we regressed participants’ support for redistribution simultaneously on their dispositional compassion, their dispositional envy, and their expected personal gain (or loss) from redistribution. As predicted, the three motives have positive, significant, and independent effects on support for redistribution. This is true in the four countries tested: the United States (US) (study 1a), India (IN) (study 1b), the United Kingdom (GB) (study 1c), and Israel (IL) (study 1d)—standardized regression coefficients (β values): compassion, 0.28–0.39; envy, 0.10–0.14; self-interest, 0.18–0.30. Jointly, these motives account for 13–28% of the variance in support for redistribution. Adding to the regression models age and gender, or age, gender, and S[ocio]E[conomic]S[tatus], does not appreciably alter the effect of the emotion/motivation triplet, or the total variance accounted for. We note that age did not have significant effects in any country. Gender had significant effects in the United States and the United Kingdom (females more opposed to redistribution), but not in India or Israel. SES had a significant (negative) effect in the United Kingdom, but not in the other countries (Ibid.).

Participants in the United States, India, and the United Kingdom (studies 1a–c) were given two hypothetical scenarios and asked to indicate their preferred one. In one scenario, the wealthy pay an additional 10% in taxes, and the poor receive an additional sum of money. In the other scenario, the wealthy pay an additional 50% in taxes (i.e., a tax increment five times greater than in the first scenario), and the poor receive (only) one-half the additional amount that they receive in the first scenario. That is, higher taxes paid by the wealthy yielded relatively less money for the poor, and vice versa (63). To clarify the rationale for this trade-off, we told participants that the wealthy earned more when tax rates were low, thereby generating more tax revenue that could be used to help the poor. Fourteen percent to 18% of the American, Indian, and British participants indicated a preference for the scenario featuring a higher tax rate for the wealthy even though it produced less money to help the poor…We regressed this wealthy-harming preference simultaneously on support for redistribution, the emotion/motivation triplet, age, gender, and SES. Dispositional envy was the only reliable predictor (Ibid.).

Participants in the United States, India, and the United Kingdom (studies 1a–c) were given two hypothetical scenarios and asked to indicate their preferred one. In one scenario, the wealthy pay an additional 10% in taxes, and the poor receive an additional sum of money. In the other scenario, the wealthy pay an additional 50% in taxes (i.e., a tax increment five times greater than in the first scenario), and the poor receive (only) one-half the additional amount that they receive in the first scenario. That is, higher taxes paid by the wealthy yielded relatively less money for the poor, and vice versa (63). To clarify the rationale for this trade-off, we told participants that the wealthy earned more when tax rates were low, thereby generating more tax revenue that could be used to help the poor. Fourteen percent to 18% of the American, Indian, and British participants indicated a preference for the scenario featuring a higher tax rate for the wealthy even though it produced less money to help the poor…We regressed this wealthy-harming preference simultaneously on support for redistribution, the emotion/motivation triplet, age, gender, and SES. Dispositional envy was the only reliable predictor (Ibid.).

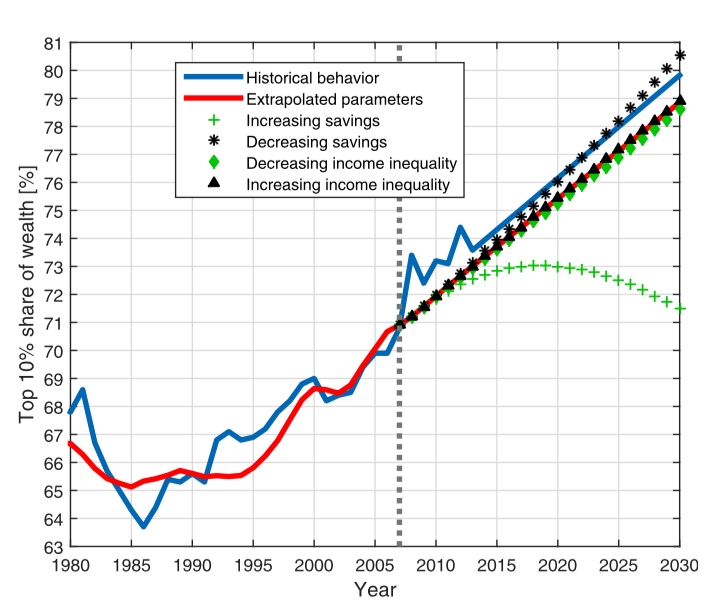

they also grow domestically, as demonstrated by

they also grow domestically, as demonstrated by