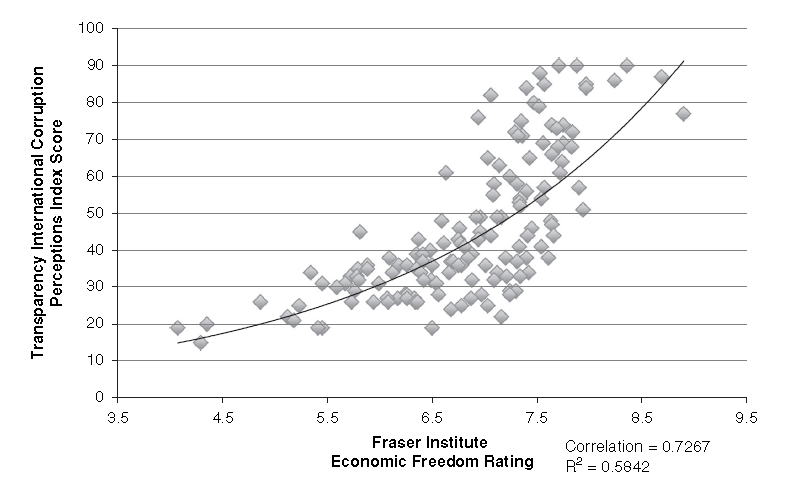

In a paper I have under review, I cite an article by Jason Brennan that points to “a robust positive correlation between countries’ degree of economic freedom (as measured by the Fraser Institute’s economic freedom ratings) and countries’ lack of corruption (as measured by Transparency International’s Corruption Perceptions Index.”[ref]Jason Brennan, “Do Markets Corrupt?” in Economics and the Virtues: Building a New Moral Foundation, ed. Jennifer A. Baker, Mark D. White (New York: Oxford University Press, 2016), 240.[/ref]

Recent studies offer further support to this correlation:

These twin policies [anticorruption reforms and high-quality market institutions] resonate with economic research revealing a mutually reinforcing feedback loop between corruption and stalled development. Corrupt officials misappropriating government money defund public goods and services, including those that might deter corruption. Bribing corrupt officials for regulatory favours or subsidies diverts corporate spending away from investing in productivity and corporate attention away from market signals. This stalls growth, and stalled growth locks in corruption (Krueger 1974, Fisman and Svensson 2007, Ayyagari et al. 2014).

Unfortunately, corruption is an enticing ‘second best’ optimal policy for key actors in an economy with an interventionist government. Bribes grease squeaky bureaucratic wheels to help businesses get things done where officials, not markets, allocate key resources. Bribes supplement officials’ incomes where stunted economic activity keeps government revenues low (Fisman 2001, Wei 2001, McMillan and Woodruff 2002, Li et al. 2008, Calomiris et al. 2010, Agarwal et al. 2015, Zeume 2016).

But once entered, this second-best thinking can entrap a whole economy in a low-level pit (e.g. Murphy et al. 1993, Morck et al. 2005). Powerful officials rationally focus on maximising bribe income (even erecting artificial regulatory barriers they can take bribes for removing), rather than institution building. Profit-maximising firms rationally invest in bribing officials because bribes, not enhancing productivity or responding to market signals, have higher returns. This explains clear empirical findings (e.g. Mauro 1995) linking worse corruption to slower growth.

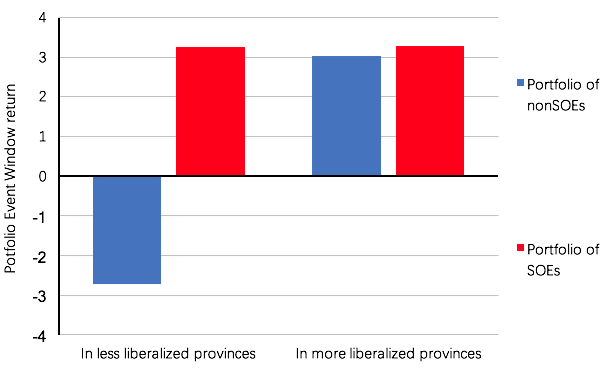

The authors note that almost “half of China’s listed firms are S[tate ]O[wned ]E[nterprise]s, and the anticorruption Policy affected SOEs and non-SOEs differently.” They continue,

In less liberalised provinces, officials still allocate key resources, so bribing them is critical to get anything done. Deprived of the ability to pay bribes, their non-SOEs might be caught in frozen bureaucratic gears (e.g. Wei 2001). Expecting this, shareholders would price non-SOEs in less liberalised provinces lower on news of the anticorruption Policy.

In more liberalised provinces, where market forces allocate resources, officials still solicit bribes, but as fees for passing artificial ‘toll booths’ they erect in non-SOEs paths. The new Policy was designed to suppress this behaviour, freeing non-SOEs of these tollbooth fees. Expecting this, shareholders would price non-SOEs in more liberalised provinces higher on news of the anticorruption Policy.

Figure 2, based on findings in Lin et al. (2017), shows exactly this pattern across portfolios of mainland traded shares. SOE shares gain on news of the reform. Non-SOEs in economically liberalised provinces also gain, but non-SOEs in less reformed provinces drop sharply.

With the announcement of anticorruption reforms, investors “expect[ed] curtailed corruption to advantage non-SOEs previously more encumbered by official ‘toll booths’. Their regressions also show more non-SOEs with higher productivity, more external financing needs, and greater growth potential gaining more on news of the Policy if located in more liberalised provinces.” Furthermore, “Li et al. (2017) find evidence of a shift in credit allocation towards non-SOEs and away from SOEs as the anticorruption reforms took hold. Event studies of subsequent news of follow-on provincial anticorruption policies show non-SOEs, but not SOEs, gaining more (e.g. Ding et al. 2017). These findings are readily interpretable as reinforcing Lin et al.’s findings – investors’ initial expectations about the impact of reforms on SOEs remained unchanged, but the provincial buy-ins led investors to further boost the valuations on non-SOEs in more liberalised provinces.” The authors conclude,

Reducing corruption creates more value where market reforms are already more fully implemented. If officials, rather than markets, allocate resources, bribes can be essential to grease bureaucratic gears to get anything done. Thus, non-SOEs stocks actually decline in China’s least liberalised provinces – e.g. Tibet and Tsinghai – on news of reduced expected corruption. These very real costs of reducing corruption can stymie reforms, and may explain why anticorruption reforms often have little traction in low-income countries where markets also work poorly.

China has shown the world something interesting: prior market reforms clear away the defensible part of opposition to anticorruption reforms. Once market forces are functioning, bribe-soliciting officials become a nuisance rather than tools for getting things done. Eliminating pests is more popular than taking tools away.

These patterns in Chinese stock price reactions to news of a genuinely unexpected and seemingly real anticorruption reform suggest the existence of a feedback loop that reform-minded leaders might activate. Market reforms clear the way for anticorruption reforms, and create an advantage for more productive market-ready private sector firms. These are the sorts of firms that are more likely to invest shareholders’ money in productivity-enhancing growth opportunities and less willing to pay bribes. As these firms grow stronger and more important, their self-interest in further market liberalisation and anticorruption reforms would lead them to support political leaders advocating further such reforms. A self-reinforcing upward spiral towards increased wealth and better institutions ensues.

A virtuous cycle ensues – persistent anticorruption efforts encourage market-oriented behaviour, which makes anticorruption reforms more effective, which further encourages market oriented behaviour. President Xi is right to state that anticorruption reforms are the path to developing high-quality market institutions.

Stephen Prothero, Religious Literacy: What Every American Needs to Know–And Doesn’t (HarperCollins, 2007): “The United States is one of the most religious places on earth, but it is also a nation of shocking religious illiteracy.

Stephen Prothero, Religious Literacy: What Every American Needs to Know–And Doesn’t (HarperCollins, 2007): “The United States is one of the most religious places on earth, but it is also a nation of shocking religious illiteracy. Steven Reiss, The 16 Strivings for God: The New Psychology of Religious Experience (Mercer University Press, 2015): “This ground-breaking work will change the way we understand religion. Period. Previous scholars such as Freud, James, Durkheim, and Maslow did not successfully identify the essence of religion as fear of death, mysticism, sacredness, communal bonding, magic, or peak experiences because religion has no single essence. Religion is about the values motivated by the sixteen basic desires of human nature. It has mass appeal because it accommodates the values of people with opposite personality traits. This is the first comprehensive theory of the psychology of religion that can be scientifically verified. Reiss proposes a peer-reviewed, original theory of mysticism, asceticism, spiritual personality, and hundreds of religious beliefs and practices. Written for serious readers and anyone interested in psychology and religion (especially their own), this eminently readable book will revolutionize the psychology of religious experience by exploring the motivations and characteristics of the individual in their religious life” (

Steven Reiss, The 16 Strivings for God: The New Psychology of Religious Experience (Mercer University Press, 2015): “This ground-breaking work will change the way we understand religion. Period. Previous scholars such as Freud, James, Durkheim, and Maslow did not successfully identify the essence of religion as fear of death, mysticism, sacredness, communal bonding, magic, or peak experiences because religion has no single essence. Religion is about the values motivated by the sixteen basic desires of human nature. It has mass appeal because it accommodates the values of people with opposite personality traits. This is the first comprehensive theory of the psychology of religion that can be scientifically verified. Reiss proposes a peer-reviewed, original theory of mysticism, asceticism, spiritual personality, and hundreds of religious beliefs and practices. Written for serious readers and anyone interested in psychology and religion (especially their own), this eminently readable book will revolutionize the psychology of religious experience by exploring the motivations and characteristics of the individual in their religious life” ( Alfred R. Mele, Free: Why Science Hasn’t Disproved Free Will (Oxford University Press, 2014): “Does free will exist? The question has fueled heated debates spanning from philosophy to psychology and religion. The answer has major implications, and the stakes are high. To put it in the simple terms that have come to dominate these debates, if we are free to make our own decisions, we are accountable for what we do, and if we aren’t free, we’re off the hook. There are neuroscientists who claim that our decisions are made unconsciously and are therefore outside of our control and social psychologists who argue that myriad imperceptible factors influence even our minor decisions to the extent that there is no room for free will. According to philosopher Alfred R. Mele, what they point to as hard and fast evidence that free will cannot exist actually leaves much room for doubt. If we look more closely at the major experiments that free will deniers cite, we can see large gaps where the light of possibility shines through. In Free: Why Science Hasn’t Disproved Free Will, Mele lays out his opponents’ experiments simply and clearly, and proceeds to debunk their supposed findings, one by one, explaining how the experiments don’t provide the solid evidence for which they have been touted. There is powerful evidence that conscious decisions play an important role in our lives, and knowledge about situational influences can allow people to respond to those influences rationally rather than with blind obedience. Mele also explores the meaning and ramifications of free will. What, exactly, does it mean to have free will — is it a state of our soul, or an undefinable openness to alternative decisions? Is it something natural and practical that is closely tied to moral responsibility? Since evidence suggests that denying the existence of free will actually encourages bad behavior, we have a duty to give it a fair chance” (

Alfred R. Mele, Free: Why Science Hasn’t Disproved Free Will (Oxford University Press, 2014): “Does free will exist? The question has fueled heated debates spanning from philosophy to psychology and religion. The answer has major implications, and the stakes are high. To put it in the simple terms that have come to dominate these debates, if we are free to make our own decisions, we are accountable for what we do, and if we aren’t free, we’re off the hook. There are neuroscientists who claim that our decisions are made unconsciously and are therefore outside of our control and social psychologists who argue that myriad imperceptible factors influence even our minor decisions to the extent that there is no room for free will. According to philosopher Alfred R. Mele, what they point to as hard and fast evidence that free will cannot exist actually leaves much room for doubt. If we look more closely at the major experiments that free will deniers cite, we can see large gaps where the light of possibility shines through. In Free: Why Science Hasn’t Disproved Free Will, Mele lays out his opponents’ experiments simply and clearly, and proceeds to debunk their supposed findings, one by one, explaining how the experiments don’t provide the solid evidence for which they have been touted. There is powerful evidence that conscious decisions play an important role in our lives, and knowledge about situational influences can allow people to respond to those influences rationally rather than with blind obedience. Mele also explores the meaning and ramifications of free will. What, exactly, does it mean to have free will — is it a state of our soul, or an undefinable openness to alternative decisions? Is it something natural and practical that is closely tied to moral responsibility? Since evidence suggests that denying the existence of free will actually encourages bad behavior, we have a duty to give it a fair chance” ( Brink Lindsey, Human Capitalism: How Economic Growth Has Made Us Smarter–and More Unequal (Princeton University Press, 2013): “What explains the growing class divide between the well educated and everybody else? Noted author Brink Lindsey, a senior scholar at the Kauffman Foundation, argues that it’s because economic expansion is creating an increasingly complex world in which only a minority with the right knowledge and skills–the right “human capital”–reap the majority of the economic rewards. The complexity of today’s economy is not only making these lucky elites richer–it is also making them smarter. As the economy makes ever-greater demands on their minds, the successful are making ever-greater investments in education and other ways of increasing their human capital, expanding their cognitive skills and leading them to still higher levels of success. But unfortunately, even as the rich are securely riding this virtuous cycle, the poor are trapped in a vicious one, as a lack of human capital leads to family breakdown, unemployment, dysfunction, and further erosion of knowledge and skills. In this brief, clear, and forthright eBook original, Lindsey shows how economic growth is creating unprecedented levels of human capital–and suggests how the huge benefits of this development can be spread beyond those who are already enjoying its rewards” (

Brink Lindsey, Human Capitalism: How Economic Growth Has Made Us Smarter–and More Unequal (Princeton University Press, 2013): “What explains the growing class divide between the well educated and everybody else? Noted author Brink Lindsey, a senior scholar at the Kauffman Foundation, argues that it’s because economic expansion is creating an increasingly complex world in which only a minority with the right knowledge and skills–the right “human capital”–reap the majority of the economic rewards. The complexity of today’s economy is not only making these lucky elites richer–it is also making them smarter. As the economy makes ever-greater demands on their minds, the successful are making ever-greater investments in education and other ways of increasing their human capital, expanding their cognitive skills and leading them to still higher levels of success. But unfortunately, even as the rich are securely riding this virtuous cycle, the poor are trapped in a vicious one, as a lack of human capital leads to family breakdown, unemployment, dysfunction, and further erosion of knowledge and skills. In this brief, clear, and forthright eBook original, Lindsey shows how economic growth is creating unprecedented levels of human capital–and suggests how the huge benefits of this development can be spread beyond those who are already enjoying its rewards” ( Gretchen Rubin, Better Than Before: What I Learned About Making and Breaking Habits–to Sleep More, Quit Sugar, Procrastinate Less, and Generally Build a Happier Life (Broadway Books, 2015): “How do we change? Gretchen Rubin’s answer: through habits. Habits are the invisible architecture of everyday life. It takes work to make a habit, but once that habit is set, we can harness the energy of habits to build happier, stronger, more productive lives. So if habits are a key to change, then what we really need to know is: How do we change our habits? Better than Before answers that question. It presents a practical, concrete framework to allow readers to understand their habits—and to change them for good. Infused with Rubin’s compelling voice, rigorous research, and easy humor, and packed with vivid stories of lives transformed, Better than Before explains the (sometimes counter-intuitive) core principles of habit formation. Along the way, Rubin uses herself as guinea pig, tests her theories on family and friends, and answers readers’ most pressing questions—oddly, questions that other writers and researchers tend to ignore:

Gretchen Rubin, Better Than Before: What I Learned About Making and Breaking Habits–to Sleep More, Quit Sugar, Procrastinate Less, and Generally Build a Happier Life (Broadway Books, 2015): “How do we change? Gretchen Rubin’s answer: through habits. Habits are the invisible architecture of everyday life. It takes work to make a habit, but once that habit is set, we can harness the energy of habits to build happier, stronger, more productive lives. So if habits are a key to change, then what we really need to know is: How do we change our habits? Better than Before answers that question. It presents a practical, concrete framework to allow readers to understand their habits—and to change them for good. Infused with Rubin’s compelling voice, rigorous research, and easy humor, and packed with vivid stories of lives transformed, Better than Before explains the (sometimes counter-intuitive) core principles of habit formation. Along the way, Rubin uses herself as guinea pig, tests her theories on family and friends, and answers readers’ most pressing questions—oddly, questions that other writers and researchers tend to ignore: Drew Magary, The Hike: A Novel (Penguin, 2016): “When Ben, a suburban family man, takes a business trip to rural Pennsylvania, he decides to spend the afternoon before his dinner meeting on a short hike. Once he sets out into the woods behind his hotel, he quickly comes to realize that the path he has chosen cannot be given up easily. With no choice but to move forward, Ben finds himself falling deeper and deeper into a world of man-eating giants, bizarre demons, and colossal insects. On a quest of epic, life-or-death proportions, Ben finds help comes in some of the most unexpected forms, including a profane crustacean and a variety of magical objects, tools, and potions. Desperate to return to his family, Ben is determined to track down the “Producer,” the creator of the world in which he is being held hostage and the only one who can free him from the path. At once bitingly funny and emotionally absorbing, Magary’s novel is a remarkably unique addition to the contemporary fantasy genre, one that draws as easily from the world of classic folk tales as it does from video games. In The Hike, Magary takes readers on a daring odyssey away from our day-to-day grind and transports them into an enthralling world propelled by heart, imagination, and survival” (

Drew Magary, The Hike: A Novel (Penguin, 2016): “When Ben, a suburban family man, takes a business trip to rural Pennsylvania, he decides to spend the afternoon before his dinner meeting on a short hike. Once he sets out into the woods behind his hotel, he quickly comes to realize that the path he has chosen cannot be given up easily. With no choice but to move forward, Ben finds himself falling deeper and deeper into a world of man-eating giants, bizarre demons, and colossal insects. On a quest of epic, life-or-death proportions, Ben finds help comes in some of the most unexpected forms, including a profane crustacean and a variety of magical objects, tools, and potions. Desperate to return to his family, Ben is determined to track down the “Producer,” the creator of the world in which he is being held hostage and the only one who can free him from the path. At once bitingly funny and emotionally absorbing, Magary’s novel is a remarkably unique addition to the contemporary fantasy genre, one that draws as easily from the world of classic folk tales as it does from video games. In The Hike, Magary takes readers on a daring odyssey away from our day-to-day grind and transports them into an enthralling world propelled by heart, imagination, and survival” (