Economists Wojciech Kopczuk and Allison Schrager have a Foreign Affairs article with the eye-catching title “The Inequality Illusion.” The two argue that “imposing a tax on wealth is a terrible way to promote equality. It actually benefits the super wealthy the most.” They continue:

Economists Wojciech Kopczuk and Allison Schrager have a Foreign Affairs article with the eye-catching title “The Inequality Illusion.” The two argue that “imposing a tax on wealth is a terrible way to promote equality. It actually benefits the super wealthy the most.” They continue:

What is not widely understood is that the growth in income inequality [in the U.S.] has been driven almost entirely by earned income, that is, what people are paid for their work rather than what they earn on their investments.

Wealth inequality refers to the stock of people’s assets. It represents the accumulation of saved income and returns on investments over the years. Some wealth inequality is inevitable, even desirable, because wealth represents a lifetime of saving and not just luck or opportunity. Extreme income inequality can beget extreme wealth inequality because people with a lot of income, if they save, can amass large fortunes and pass them on to their children. But over time, such wealth can also dissipate as people leave it to multiple children, get married and divorced, develop expensive lifestyles, contribute to charities, or make poor investment decisions. Whereas income inequality has clearly worsened, the recent evidence about wealth inequality is much less convincing.

After reviewing a number of sources, they declare, “Taken together, then, the economic evidence points to increased earnings inequality but to a much more benign picture of changes in wealth inequality. Increasing inequality has been driven by income earners not necessarily by the entrenched wealth holders.”

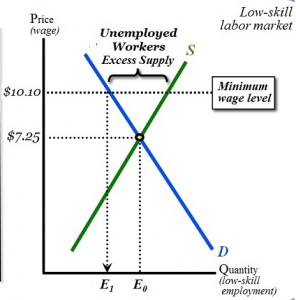

Given the recent controversy over errors in Thomas Piketty’s data (errors that may or may not undermine his argument),[ref]The FT analysis is likely the most famous (update: Financial Times has a follow-up post), but others have found some major errors as well. For example, former chief economist for the U.S. Department of Labor Diana Furchtgott-Roth has pointed out Piketty’s errors in the history of the U.S. minimum wage. Economist Randall Holcombe has written on the “fundamental problems with the way [Piketty] depicts capital.” Inequality expert Scott Winship has two articles in Forbes that are also quite critical of Piketty. Economist Robert Murphy disputes Piketty’s tax history. In response to a recent Spectator article contrasting Deirdre McCloskey and Piketty, GMU economist Don Boudreaux writes, “[I]ndispensable to our modern prosperity is not only the innovative creation of capital but also the continual destruction of capital that such successful innovation entails…What is destroyed is not only some jobs (e.g., t.v. repairman) and the value of some consumer goods (e.g., crutches for polio victims) and services (e.g., postal delivery), but also the value of capital. Capitalism’s nature is not, contrary to Piketty’s claim, to forever protect and augment existing capital. Central to capitalism’s nature is what McCloskey calls “market-tested innovation.” And this innovation inevitably destroys the value of older, less-productive capital that is in competition with with it – in competition with the new capital, the new goods, the new production and consumption processes, and the new knowledge that innovative entrepreneurs create.” Update: A brand new paper out of Yale disputes Piketty’s “second law of capitalism.”[/ref] the above article is quite timely.

Check it out.